Car features ‘nag’ for your safety

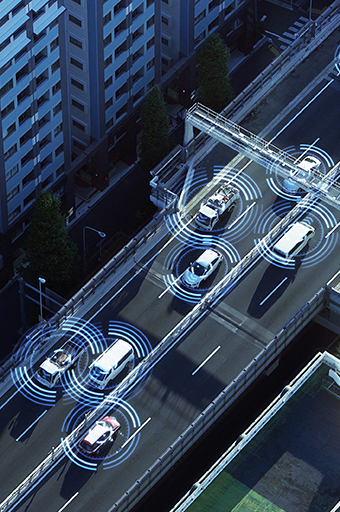

Once upon a time, the air bag was the pinnacle of car safety. Today, new cars feature advanced driver-assistance systems, which allow the car to apply the brakes before a collision, to steer around obstacles or to alert drivers about hazards in their blind spots.

However, these safety features will help you only if you keep them enabled. According to J.D. Power’s 2019 U.S. Tech Experience Index Study, some consumers turned off certain safety features because they found them “annoying or bothersome.” Among the more disliked features were systems designed to keep drivers in their proper lane. The study found that 23% of drivers with those systems complained that the alerts were annoying (conversely, 21% of drivers with those systems, who responded to the study, didn’t consider them “annoying or bothersome”). Additionally, 61% of the respondents said they disabled the systems sometimes.

Insurance considerations

Unlike other car safety features—advanced driver-assistance systems do not qualify for insurance premium discounts from most insurance companies (yet)—although some companies apply discounts for cars with automatic emergency braking—when a car brakes automatically to avoid a crash.

Why? New technology costs more money, especially if it needs to be replaced or repaired, so your car insurance premium may increase. But, this shouldn’t stop you from considering a car with these safety features because they may help you avoid an accident, which will lessen the chance that your premiums will go up afterward.

While advanced driver-assistance systems do not offer many opportunities for insurance discounts right now, many car insurance companies give premium discounts for other safety features—the most common is for anti-lock brakes, air bags, daytime running lights, electronic stability control and automatic seat belts. If you have a new car—or are considering buying a new car with advanced safety features—give our agency a call, we’ll help you get the discounts for which you may qualify.

Leave a Reply

Want to join the discussion?Feel free to contribute!